What Small Business Owners Need to Know About FinCEN’s Beneficial Owner Information Filing Requirements

A significant development in regulatory compliance is upon us that will impact millions of small businesses nationwide. The Corporate Transparency Act (CTA), effective as of January 1, 2024, mandates that businesses must submit details about their...

Strategic Equipment Purchase Planning: Navigating Tax Implications for Your Business

When planning major equipment purchases, business owners often face a crucial tax planning decision: whether to make the purchase this year or the next. This decision primarily revolves around several key factors, with the most significant being...

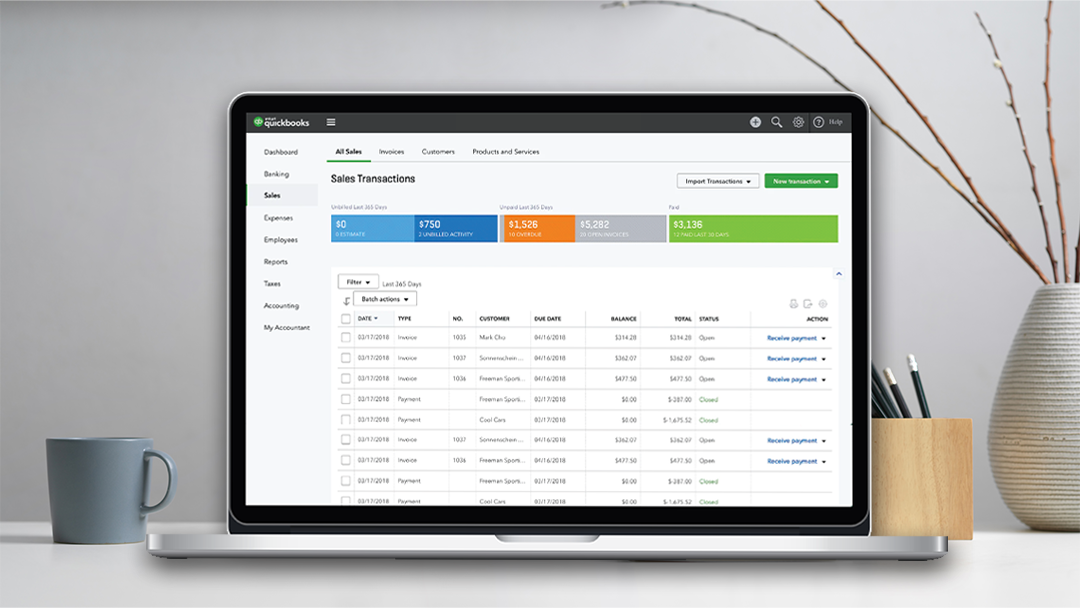

6 Reasons to Switch from QuickBooks Desktop to QuickBooks Online

QuickBooks Desktop was a revolutionary product for small businesses, dating back to the 1990s. This product still inspires strong loyalty. However, its cloud-based alternative, QuickBooks Online (QBO), launched about a decade ago, has been gaining...

Are Medical Malpractice Settlement Awards Taxable?

Receiving a cash settlement from a medical malpractice case can be a huge relief after what is usually a long and protracted process. But before you spend it, make sure you’re aware of any tax impacts it may have. The good news is that most of the...

Everything You Need to Know About Gifting

Making generous gifts to others isn’t just about sharing your abundance with others – it’s also smart estate planning. But if you don’t follow the rules, you – or your estate – could face an expensive gift tax bill. Here’s what you need to know...

What Business Owners Need to Know About 1099’s

An important aspect of tax compliance for business owners is the requirement to file a 1099 for certain payments made during the normal course of business. If you are a business owner, below is a summary of what you need to know....

Why is the Income on My K-1 Different from the Cash I Received?

Making the switch from employee to business owner requires some getting used to. One of those adjustments is understanding the difference between the income reported on a K-1 and the amount of cash distributions received. Let’s look at some of the...

Cut Your Tax Bill When You Convert Personal Expenses to Deductible Business Expenses

Owning your own business can provide opportunities to reduce taxes that you might not necessarily have as an employee, and the best place to start is to convert personal expenses that you would otherwise incur to legitimate business expenses. Below...

Enrolled Agent vs. CPA – What’s the Difference?

What is an Enrolled Agent? Although no formal credentials are required to work as a tax preparer in the U.S., hiring one with a professional license protects your interests. Besides the obvious choice of hiring a CPA, an Enrolled Agent, or EA, is...

The SECURE ACT’s “10-Year Rule” for Inherited IRAs

On Friday, December 20, 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law. The broad intent of the legislation is to make it easier for families to save more for retirement, but it also includes...